2025 will be a tough year, I pity the next president – Jantuah

2025 will be a tough year, I pity the next president – Jantuah

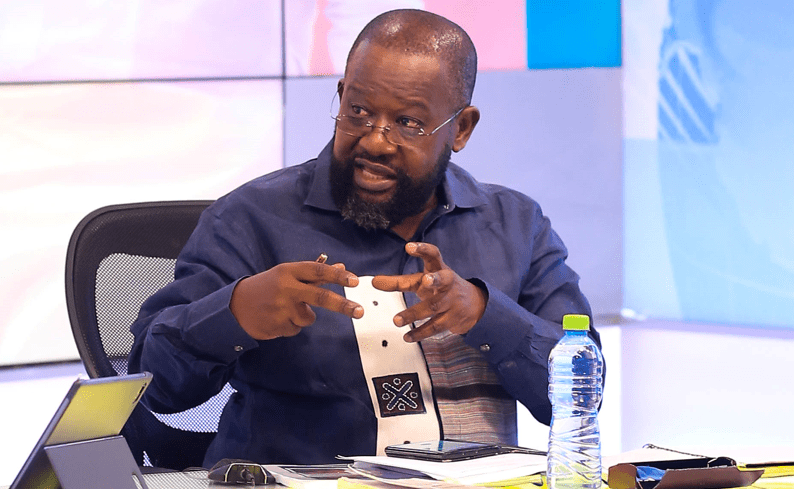

A leading member of the Convention People’s Party (CPP), Kwame Jantuah has projected tough times ahead of whoever is elected as president of Ghana in this year’s election.

He observed that Ghana will go through tough times from 2025 onwards because of the current economic challenges and the increasing debt stock.

“2025 onwards is going to be easy, I pity the next president. They should not create a picture that tells us that they will rescue us because the hole we are in is deeper than we are being shown,” he said on the Big Issue on TV3 Froday July 26.

He suggested to the next president to focus on working on the mindset of Ghanaians especially their tase for imported goods. He wants consumption of locally-produced goods to be prioritised.

“The next president should be able to bring Ghanaians board to change a certain mindset that we have especially with imports,” he said.

MrJantuah was commenting on Ghana’s public stock which stood at GH¢742 billion, representing US$50.9 billion as of June 2024 as announced by to the Finance Minister Dr Mohammed Amin Adam.

The Finance Minister while presenting the mid-year budget review on Tuesday, July 24 said that the debt stock represents 70.6 per cent of the Gross Domestic Product (GDP) he said during the 2024 mid-year budget review in parliament on Tuesday.

“The stock consists of external debt of GH¢452.0 billion and domestic debt of GH¢290.0 billion, representing 60.9 percent and 39.1 percent of the total debt stock, respectively. As a percentage of GDP, external and domestic debt represented 43.0 percent and 27.6 percent, respectively. This indicates an increase of 22 percent due to the effect of the cedi depreciation and continuous disbursements from creditors,” he said.

Dr Amin Adam further assured Ghanaians that the government is living within its budget.

He indicated that the government has reined in expenditures as part of efforts to ensure they are within 2024 Budget Appropriation.

He also said that they have exceeded the midyear revenue target by 0.2 percent by end-June, 2024.

“In effect, Mr. Speaker, we are living within our means. Indeed, consistent with our programme with the IMF, we are on course to achieving a primary surplus of 0.5 percent of GDP by end of the year.

“We have successfully concluded the second review of our Extended Credit Facility with the International Monetary Fund (IMF) which led to the disbursement of the 3rd tranche of 360 million US Dollars, bringing total disbursement to about US$1.6 billion; We have completed the Debt Restructuring programme with the Official Creditor Committee (OCC), covering US$5.1 billion dollars resulting in approximately 2.8 billion US Dollars of debt relief. This means that we will not service our debt to our official creditors from 2023 to 2026;

“We have concluded negotiations with our Eurobond holders, covering 13.1 billion US Dollars, which will lead to a cancellation of 4.7 billion US Dollars of our debt and provide debt service relief of 4.4 billion US Dollars between 2023 and 2026.

“We have concluded our negotiations with five (5) of the seven (7) Independent Power Producers, which will lead to a saving of some of US$6.6 US Billion over the lifetime of the Purchasing Power Agreements (PPAs); We have cleared all outstanding Bank Transfer Advice (BTAs) up to 2022, and working hard to pay BTAs from 2023;

“We have embarked on major reforms of State Owned Enterprises (SOEs), especially those in the Energy and Cocoa sectors, to be fiscally prudent and reduce their risk on the budget,” he said.